Monthly Update #7 June 2019 – 6 Months Already?

I normally live the month of June quite actively. There are more outdoors events or stuff going on, people are more cheerful, they want to meet, eat, do, practice all sort of things, and spend more too! In Catalonia, the area I am from, it’s the time when we start making barbecues with friends, go running, cycling, make picnic meetups by the lake or ponds while relaxing, swimming and having some fun.

June in Brighton, where I lived my first 4 years in England, was normally pretty cool too. I and my friends were getting crazy when warmer days were coming and used to meet often. We had quick instant barbecues (tasteless but fun) on the beach, drunk all types of beer brands and coffees from around the world, tasted all types of cuisines (even Spanish LOL!), played basketball or volleyball on the seafront and other sorts of crazy things.

I know there are some Europeans reading my blog. Guys if you are considering to come to the UK to improve your English, Brighton is such a great place. Your wallet won’t be very happy about it, but the life experience you will have is priceless and you won’t feel lonely. 100% guaranteed. Although, it may be better just to go to Ireland with the current Brexiting mess (well, unless the Pound drops below the Euro, of course!)

Anyway, now I live in a lost town somewhere in West Sussex for the fact of saving money and time on commuting. Here everyone is British (63% Brexiteers), Polish or Romanian. There are no Italians, Spanish, Portuguese or Greeks or any Southern Europeans living here – nationalities I often tend to get well with. When I walk to town, people look to me awkwardly, are these people telling me “get out of my country” silently? Or is it just my mind’s imagination? That makes me feel a bit isolated sometimes, not Londoner vibes here!

Because of that, I am struggling to make good friends, at least the type of open-minded friends I would like to have, and not those who are destroying their lives by spending their free time smoking marijuana, taking drugs or participating in competitions type “who is the bravest by being the foolest”.

The good side though is that I have spent less money and saved more this month. More on this at the bottom of the post, as usual 😉

This blog is turning more into a personal diary or journal. I don’t know whether this is boring or not for others to read but it is the way I am enjoying it to be.

Enough chattering, it’s time to get into the action of my investments, where a lot has been going on.

Three

Two

One

Table of Contents

Vamos!

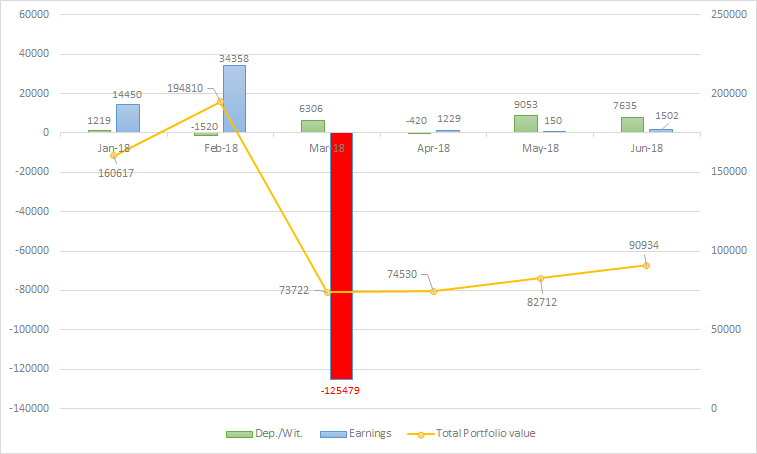

- Portfolio value: 90,934 (+9.9 %) – details HERE

- Monthly Transactions (Deposits – Withdrawals): 7,635 € – details HERE

- Monthly growth from investments: 1,502 € (+1.8%)

- Passive income: 391 € (+0.25%) – details HERE

- The €45K Project Fund value is 326 € (275.7 € in May, +18% increase)

- Weeks as a non-smoker: 5! (I feel so healthy! despite eating crap…)

- Lost £30 on match betting this month. It’s Manuel’s fault, not mine 😛

Monthly earnings by platform

Both of my stocks, AMAT and FSLR have moved higher +13.3% overall and I got a dividend payment of 4.48 EUR.

My alternative investments have performed excellently, being

The GBP/EUR currency ratio keeps decreasing from 1.13 in May to 1.11 affecting the value of my portfolio 🙁

| Platform | Inception date | Value May | Transactions | Value June | Earnings | Return June | Cumulative Return |

|---|---|---|---|---|---|---|---|

| Vanguard (£) | 14/03/2018 | 36,252 (40,964.76 €) | +5830 (6471.3 €) | 43,060 (47,796.6 €) | 977 (1,084.47 €) | 2.7 % | 11.6 % |

| Property Partner (£) | 21/01/2018 | 5,921 (6,690.73 €) | +998 (1107.8 €) | 6,894 (7,652.34 €) | -24 ( -26.6€) | -0.4 % | 7.4 % |

| Housers | 26/03/2018 | 6,690 | 0 | 6,701 | 11 | 0.17 % | 4.7 % |

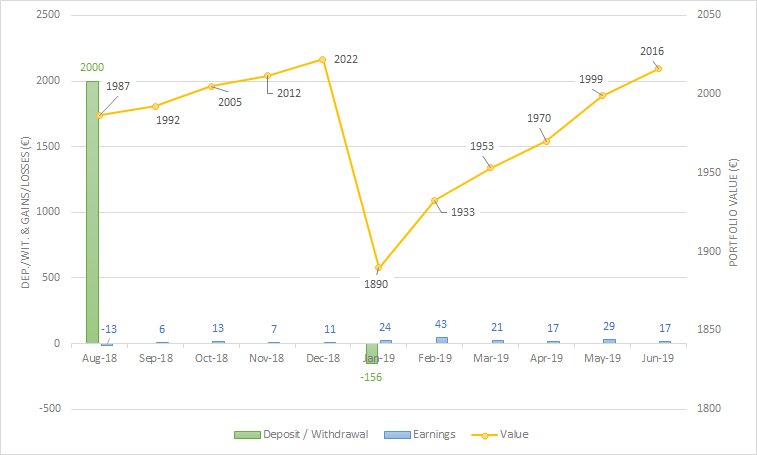

| Crowdestate | 16/08/2018 | 1,999 | 0 | 2,016 | 17 | 0.9% | 9 % |

| EstateGuru | 10/05/2019 | 2,003.7 | 0 | 2,013.4 | 9,7 | 0.48 % | 0.67 % |

| Grupeer | 19/05/2018 | 11,296 | 0 | 11,424 | 128 | 1.1 % | 17.6 % |

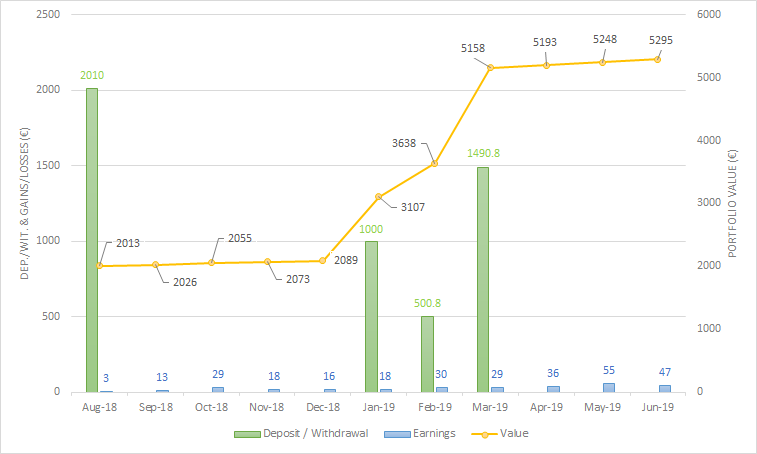

| Mintos | 05/08/2018 | 5,248 | 0 | 5,295 | 47 | 0.9 % | 8.8 % |

| Envestio | 15/10/2018 | 5,332 | 0 | 5,410 | 78 | 1.5 % | 12.6 % |

| Fast Invest | 29/10/2018 | 1,078 | 0 | 1,090.4 | 12 | 1.1 % | 9 % |

| Abundance (£) | 31/05/2019 | 244 (275.7 €) | 50 (55.5 €) | 294 (326.3 €) | 0 | 0 % | 0 % |

| Trading 212 | 03/2019 | 1,067 € | 0 | 1,209 | 142 | 13.3 % | 16.1% |

| TOTAL | 82,646 € | 7635 € | 90,934.04 € | 1502,6 € | 1.82% | -42.2% * |

*Includes Algotechs loss

Vanguard

The Pound keeps losing value, so same as in May, I converted a pile of 6000 EUR to 5330£ and transferred it to my ISA.

One thing is certain, whether we leave or stay in the UK, I want to max out my ISA. I still got over £8K left, so got some room for further exchanging if the Pound keeps dropping.

As usual, besides this move I paid myself another £500 out of my payslip.

I am also going to decrease the risk ratio of my ISA portfolio by increasing the percentage of bonds against stocks. It is currently pretty defensive at a 50/50, but I am going to slowly change this proportion for a 40/60, 40% stocks and 60% bonds, increasing especially my stake on Treasury Bills and Short Term Corporate Bonds.

As Benjamin Graham says, the portfolio allocation should be between 25/75 and 75/25. The proportion you choose between depends on your risk tolerance and also the current market valuations, which appear to be high at the moment, at least in the USA, where most of my ISA is concentrated. Also, this is my core investment, so I want to shield it as I take high risks in other areas of my global portfolio. I may miss good yields or underperform the market for a few years but I am happy with that.

It’s not a race but a Marathon

So far this year:

- S&P 500 Index : +17.2 %

- My balanced Vanguard ISA: + 10.1 %

All charts and portfolio details – HERE

Vanguard is a portion of my little British Empire as an Expat

Property Partner

The rental income on Property Partner was paid on time with no issues. The dividend day is always the 5th, where all the rental income is paid at once. It was £24.2, slightly higher than last month (£24.09 in May).

However, the overall portfolio performance in June has been negative at a value of £ -22. Why?

One of my PBSA (purpose build student accommodation) building investment is facing issues with the latest fire safety

Besides that, I invested £1K in the latest property, which I found especially interesting. It’s the first Scottish PBSA, located in Aberdeen, perfect to broaden my property diversification within the UK. I also love Scotland, so I am excited to own a piece of Scottish real state 🙂

These are some of the key facts:

- Projected dividend yield of 5.04% after all fees and costs

- Student block comprising 28 ensuite rooms

- Commercial lease to Robert Gordon University until 2031 with annual RPI-linked rent reviews (min 3%)

- Located within minutes of the university campus

I think the attractiveness lays on the third point, the annual minimum rent increase of 3% for the next 12 years gives a 43% growth increase on rent by its own.

This is how my new investment property looks from the outside.

Related content: Property Partner Review & My little British Empire as an Expat

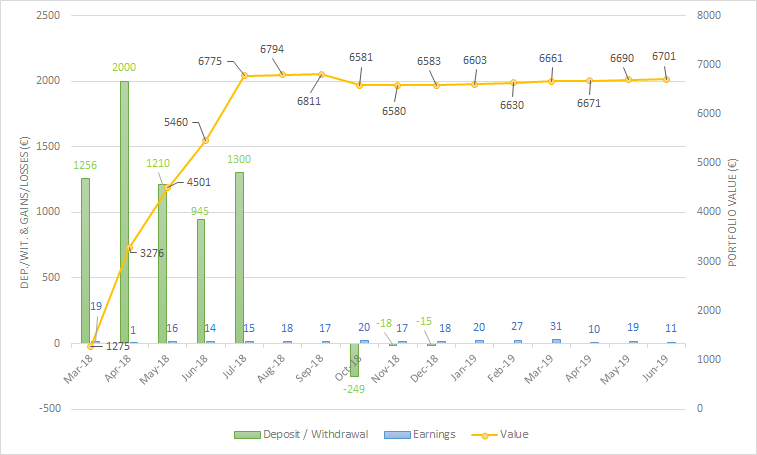

Housers

Net income from Housers in May was 11€, which is much lower than the previous month (19€). One of my development loans reached the maturity date and the principal was given back to investors successfully. I was offered a 4% cash back if I reinvested this money, which I did on one of the latest offerings.

Some people may think that I am nuts to keep investing with Housers with the current high yielding availability on the lending market. There are a couple of reasons why I haven’t exited the platform:

- Most of my investments have a 5 or 10 years set plan, and the real rate of return won’t show until then. If I would like to exit now, I would have to sell my shares at the initial price that was set back in 2018, losing one year of capitals gains (theoretically). In addition, when I started with Housers I was conscious that my money would be locked for the next 5 years at least before I can see a good return.

- It’s a solid platform regulated by the Spanish CNMV giving me some peace of mind in case things gets VERY nasty. (which happened to me once)

Related

EstateGuru

This is my second month on EstateGuru (aff. link) and the first one on earning interest income, which was 3.92 EUR. Total return is 9.7 EUR.

My total invested capital is 2K but I expect to increase it up to 3K at least, the same as I plan for…

…Crowdestate …

… which has been in my portfolio for a while,

Now I feel a bit more confident and spend more time reading reports on the Baltic economic growth.

So, I will be looking to increase my account up to 3K for now.

Audience: But, wait a minute Manuel. Are you still going to keep adding more cash to your P2P lending investments? We thought you were happy with your current percentage allocation, weren’t you?

Manuel: Exactly amigos, I am happy with it, and that’s why I will use capital from…

…Mintos

Unfortunately, I have to temporally say bye bye to my favourite crowdlending platform. Not because I want to, but because I have to.

Investors from the UK received an email from Mintos saying that they are currently developing a new business model for the UK market, and decided to temporarily stop new investments in loans from the UK residents starting from 27.06.2019.

On a later email, I was told that this is connected due to the restrictions by FCA and there is no specific time frame.

So basically, I can still keep getting interests from my current loans but I can’t purchase any. 50% of my loans are short term, so I expect to be able to withdraw 2K shortly (I currently have over 1K of free cash already, which I will withdraw soon after this update gets posted).

I think this is nothing to worry about. Although this is tedious work, I think it’s positive as it shows to me that the P2P lending market is becoming better regulated. What I am wondering now is whether the same issue will affect some of my other investments in the future 🙄

Returns from Mintos is slightly lower this month 47 EUR.

Related content: Mintos Review

Grupeer

My Grupeer account reaches a new milestone. Over 2000 EUR of passive income has been paid to me since the start, awesome 🙂

Here is how the stats of my personal account look:

Income from

Envestio

Envestio returned 78 EUR in June, up to standard. There has been a lack of new investments as they are apparently busy finalising an agreement with a new big partner, which will increase the loan availability within the platform, so this current situation should change early in July.

I have 424 EUR of cash drag which I am going to keep sitting in until I have a chance to have a look at the upcoming loans.

Fast Invest

Fast Invest retuned 12 EUR. I am looking forward to seeing the power of compounding taking effect over

The €45K Project Fund

This month I saved £50 as a non-smoker, funds I transferred to Abundance and used to invest in the Pax Apartment development loan as I explained in my previous post.

No match betting income this month. Made the mistake of accepting one special offer from Unibet, which automatically cancelled the current one I had, making me a loss of £160. I would have had a positive income of £130 otherwise. I was a bit unlucky here, but never mind, I now make sure I drink a cup of coffee before match betting!

So far, I have recovered the 0.72% of my loss = 326 EUR

44,674 EUR left to go.

Related content: Investing Ethically

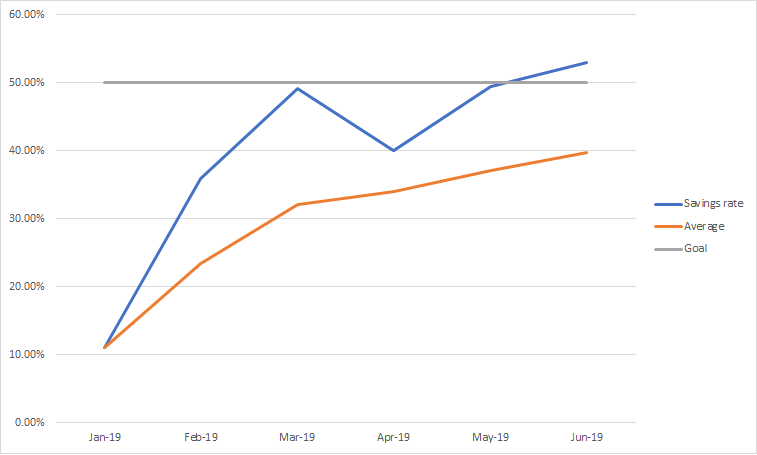

Savings Rate

My total net income in June was £1,888.56 (2096 EUR). This is slighly lower as I have opted back in my workplace pension. I am still not sure whether this is a clever decision, as if I leave I will have some money locked in here until I turn 55, losing the tax benefits. Also, as an European, a lot can happen the next 22 year in terms of politics and rules changes that may affect my investments in the UK.

Although the lower income and the match betting bump, I managed to hit a new savings ratio record! I saved £1001.7, that’s a 53% savings rate for this month!

Well done Manuel, I am proud of you 😎

In July I’ll spend one week in my beloved Catalonia and I’ll literally swallow any type of food I encounter on the way. From tortillas to paellas I will get everything in, haha. I will probably transform into a monster or something like that but I really want to enjoy real food as long as I can. That will for sure affect my saving ratio over the next month, and my belly! 🙂

Health after non -smoking

My resting heart rate keeps getting better. 58 bpm now against 71 bpm at the day I gave up smoking. I also run longer distances, I can run up to 9km before I fade compared to 3 or 4km before. Perharps it’s time to get ready for half marathon? I will keep training and see how my body progresses but I don’t rule it out.

The donation milestone

GOAL: Earn 25€ and donate it by the end of 2019.

Goal archived! Thanks to all of those who joint Mintos and EstateGuru using my links, appreciated 🙂

Now I should be entitled to payments, which I think are transferred automatically every month to my bank but I haven’t received anything yet, need to find out how it works.

I need to figure out whether I will donate the money monthly or all at once in December. I guess that if I donate now, I will raise some credibility. Any suggestions on what to do?

Besides this income, I’ve got £1 from Property Partner. Shame it’s not £1m. What a difference a single ‘m’ does!

Nothing from Oddsmonkey yet.

Joining links

Mintos (UK residents temporally not accepted)

Envestio

Fast Invest

Bulkestate (don’t invest here but got offered the affiliate link)

Oddsmonkey (UK residents only)

Trading 212 (Free shares worth up to £100 for UK resident only)

Until next time, I’ll see you around

… and once again, thanks for reading! :D

You can follow me on twitter where I share some thoughts from time to time and connect with other like-minded people and now even on Facebook too.

Disclaimer: Most of the links on this post are affiliate or referral ones. If you join to a platform using my affiliate links you will get a bonus or commission and so will I. I’m going to donate any commission I get throughout 2019 to a charity. You can read more about the purposes of this blog here and where this money is going to go here

Tags In

Tony

Related Posts

16 Comments

Leave a ReplyCancel reply

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

FINANCIAL TOOLS I USE

Online Banking

Crypto

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hey Tony, congratz on a good month! I love your new avatar! HAHA.

Good job on the Grupeer income and the savings rate!

My wife has been up my ass lately, for not investing MORE into crowdlending! HAHA. She doesn’t think those measly €100ish/month that I currently make is going to get us anywhere, I tried explaining to her that FIRE is a marathon – not a sprint, but she gets very impatient ?

I hope to one day pass €2000 earned from a single platform too! ?

Enjoy your vacation!

Hey Nick thanks! Glad to see I’m not the only who likes it, hehe 🙂

Exactly. Try showing her my March portfolio update, so she can see the likely final result of investing hastily for greed? hehe

I hope to one day be brave and confident enough to make a big and safe real estate investment as you did. That’s further more difficult than accumulating earning from a single platform 😉

Oh yes I will thanks Nick (sunshine I am coming!)

Excellent month indeed, great returns on your Vanguard portfolio.

It sure blows being let go of Mintos just like that – especially now Mintos’ returns appears to be rising lately!

Enjoy your holiday Tony, mine is still a few weeks away unfortunately.

Best

Hey thanks!

Yep, stocks have been doing great this year so that the main reason why my Vanguard portfolio has performed well too. (we’ll see how long that return will hold though)

Indeed, short terms loans up to 15% looks appealing to me, it will hopefully get sorted soon (fingers crossed)

Thanks for stopping by 🙂

That’s a great month Tony, well done! Great returns until now, it sucks that you need to withdraw from Mintos for a little while, but I assume they will have it up and running again ASAP.

You have a great P2P portfolio, I also want to invest more in it. Just got started with Envestio, unfortunately no projects yet that I can invest in. If it will be better in July I’ll be happy to dump all my money in!

Enjoy your holiday and eating all the food!!

Hey thanks Radical Fire,

Yep, it does, but I can at least withdraw my money and just allocate it somewhere else on the meantime it gets sorted, no probs 🙂

Envestio is a great platform. They sometimes run renewable energy projects like wind mill camps, other times investments related to crypto mining (not my favourite though)

Thanks yeah I will. I’ll hopefully won’t cause any food shortage problems to the rest of EU, hehe

Thanks for your time 😉

Congrats on 50%+ savings rate Tony! +Jeees, you sure do invest in a lot of different platforms ? I need to up my game.

My next ‘alt investment’ is gonna be TESLA stock, because I’m a huge Elon fan-boy.

You probably don’t live too far away from me, let’s meet for a drink or some lunch! I mean, we’re already going to build our houses together, we better meet for a drink first ?

Love your new avatar!

Hey SavingNinja,

I admire Elon Musk too, such a visionary person, actually his biography book is on my wish list (as many other that I never actually read LOL). Wasn’t he after an space project, or sth related to traveling to the space I think?

Anyway, I’ll l love to see how your investment in Tesla goes. I ‘ve been on the side-lines for a while now, but the stock price is very choppy, traders love it, so get ready to experience the meaning of volatility in its pure sense.

Love the idea! I am busy this week and off to Spain the next one, but I would happily meet you thereafter.

Would that work for you? (meeting with a Ninja sound bloody exiting haha)

I’ve read his autobiography, it’s awesome! Read all of these when you have the chance, they’re even better than the biography in my opinion -> https://waitbutwhy.com/2017/03/elon-musk-post-series.html, use a program called ‘Push to Kindle’ (Google it) to send them to your Kindle if you have one (as they’re really long, may as well be books!)

Meet up will have to come after August, I’m getting married in 3 weeks (lots to do still D: ) then I’m jetting off for a month in Cali. Let’s catch up on Twitter DM and see where we actually are in relation to each other ?

Hey thanks for your reading recommendation SavingNinja. My misses has a Kindle, so I can always use hers. I use Ipad which seems to be ok with the program too, I may use some of my holidays time to read it through, although I normally prefer to read books in Spanish or Catalan during holidays. Anyway, I will save some bucks as I won’t have to buy the book anymore 🙂

Jesus already, time flies! I can imagine how busy and full of excitement you must be, it’s a one time life experience, hope you enjoy it the fullest (I know you will)

We’ll catch on Twitter indeed 🙂

Very nice month ? Thank you for all the details. You seem to be very happy with the profit of Grupeer. Would you recommend the platform? I only have p2p-money in Mintos, but I want to invest more and diversify.

– Nordic Fire

Hey Nordic FiRE thanks for approaching 🙂

I am very happy with Grupeer so far indeed. It has been one of my best investments, as you can see on my monthly earning by platform table above. Bear in mind though, that past performance is not a guarantee of future results.

I don’t have a review, as I think there are already several out there outlining some good content, but this are the points I like the most.

Their statistics are positive, 0% defaults rate, payments on time and profitable.

Interesting rates ranging from 10% to 13%, with buyback guarantees after 60 days in case of borrower doesn’t pay.

Unlike Mintos, they have quality development loans.

Autoinvest = free of hustle

Thanks for the answer. Yeah, everyone seems to be happy with Grupeer. Have to try that out soon!

– Nordic Fire

Congrats on your six months, Tony and good to see all the numbers going up, with a great savings rate too. Unlucky with the matched betting but I still make mistakes after so many years. Well done on the bpm, keep up the great work on your health. Hope you have a great holiday.

Thank you Weenie 🙂

[…] £6 as transaction fees were changed from my latest property acquisition in Aberdeen. Remember that student party we had in June? So that’s the one amigos ;P. The purchasing has been completed this […]