Portfolio & Savings Update #29 April 2021 – 143,571€

Hola financial freedom pursuers, and welcome to another portfolio and savings update, this time being for April 2021.

Table of Contents

April In A Nutshell

This is the first update written from Spain (or Catalonia, whichever you like the most) and the last one referencing life in the UK.

We’ve made it! Albeit I did not mention it in previous posts, we were quite worried about things going wrong. We didn’t choose the best time to travel, as in the UK you are still not allowed to leave the country unless it is for a justified reason. I guess the fact of not being British nationals made it easier, as I just had to answer “I am going back to my own country” when police asked at the airport. Still, though, we filled up all required paperwork for both countries and asked for a health condition proof of my mum. That would have been my justified reason in case police would have wanted to know more. We both tested negative on Covid-19, that was another risk, so that went well too. It was quite a hustle to get all the documentation ready, it is not a good time to be far away from family and loved ones. We traveled from Gatwick North Terminal, where all flights operate at the moment. It was shocking to see the south terminal completely empty. Noth terminal was quiet, I believe there were only two flights departing at a similar time. The good thing is that we enjoyed not having delays on take-off which seemed odd in Gatwick!

Our last days in the UK were nice. I took a few days off to get everything ready. The weather was kind, we managed to visit some friends and enjoyed some lovely time in the sunshine while having my last fish and chips and proper pint of beer. We were lucky that restrictions were eased before leaving.

Once in Spain, it all got a bit more stressful. We arrived at my flat on a Saturday afternoon, a time when we realized there was no electricity. A while ago I requested a cancellation of the electricity bill of my garage, but the officer made a mistake and canceled the electricity contract of my flat instead! So that was a bit of an issue that took a few days to resolve as I had to get in touch with an architect to get some of the documentation I was asked to get back electricity. I ended up paying some nasty fees for a mistake that was not mine, so this will show on my May savings :(. Welcome back to Spain?

As we’ve been only here for one week, we are still adapting while waiting to get some of our stuff, which is still on the way from the UK. I wonder how long is going to take before I miss fish and chips?

Alright, before I get myself lost into the topic of food, I should look at April numbers, shouldn’t I?

Quick Recap of April Numbers

- Portfolio value: 143,571 € (+3.04%) – details HERE

- Contributions to the portfolio: 3,151 €

- Monthly growth from investments: 3,689 €

- Passive income: 358.62 € – details HERE

- Savings Rate: 64.1%

As opposed to 2020, this year I seem to be heading in the right direction. I haven’t had a single month of negative growth and have lost no money on P2P investments. It’s also great to see that I am getting close to my 2021 goal of increasing my portfolio to 150K! 😀

My values of passive income and savings rate are due to change from May since I will be remodelling my accounting method to account for income in Spain. Oh dear, it will get messier!

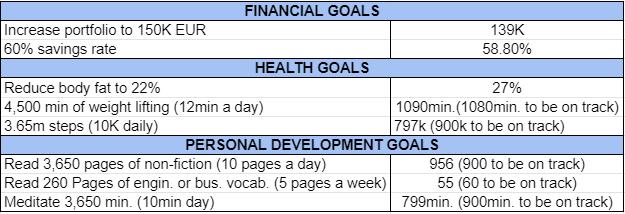

Monthly Cash Flow Sankey Diagram

Total income in April equals £2,925.47 (3,364.29 EUR).

Total expenses: £1,049.23, slightly below my average.

I did not bother about contributing to a S&S ISA for this new tax year, and I just contributed as much as I could to my SIPP.

Despite the increase in my spending on restaurants and miscellaneous (moving costs), I managed to spend less than usual as I only paid rent for two weeks (rest covered by initial deposits).

I received a payment from Google Adsense of £64.91. Thanks for the support.

I’ve recently got another payment from Google AdSense.

— Tony | Onemillionjourney.com (@JourneyMillion) April 26, 2021

It is not a lot, but as promised, I donate 50% of blog revenue to @Kiva loans.

Total donated so far amounts $143.

I wonder how much I will able to donate before I reach my one million € goal. ? pic.twitter.com/nPdf0vDHAp

April Portfolio Performance

As I like to do on a monthly basis, this is a breakdown of all my current and past investments:

Please note, links containing a star (*) are either affiliate or referral links. P2P lending is a risky business, so you could end up losing all your invested money if you choose to join any of these platforms.

** 20 % discounted to estimate future withdrawal tax payments

I am just 18.4% away from getting back to the starting point. Last month I was 20% away, so I am grateful to keep seeing an improvement month after month.

In April, I added two new investments.

The first one is a Global Clean Energy ETF, which is going to be a part of my €45K project fund. More on this later.

The second one is Reinvest24*. I had previously invested in a Reinvest24 office space project via EvoEstate, but after Covid-19 hit, I was not too confident about how office investments would perform during a working from home environment. Now having a look back at this project I see it was not impacted by Covid-19, and rental payments followed without issues. Reinvest24 seems to have done pretty well during the pandemic, which encourages me to give them a vote of confidence. So, I rejoined by investing €1000 in their latest high-yielding office space project, link here for the curious ones. They are also running a cashback bonus for new investments until 12/05/2021 to celebrate their 3rd anniversary, so that was a now or never for me!

Property Partner updated property valuations, which justifies the negative value. These valuations go up and down every quarter. I don’t pay a lot of attention to this since the real return will be given at the sale of the property, which takes place in the 5th year. Most of my investments are still in the second year, so a lot can happen between now and then.

In February, I classified the platforms I invest in between those that I sense a positive and negative outlook. My view has not changed, so if interested have a look here.

Pound Sterling falls against the Euro from 1.17 in Mach to 1.15 in April. Great to see I had some positive portfolio growth despite the devaluation.

Dividend Portfolio

My dividend portfolio in April generated 10.98 EUR of passive income.

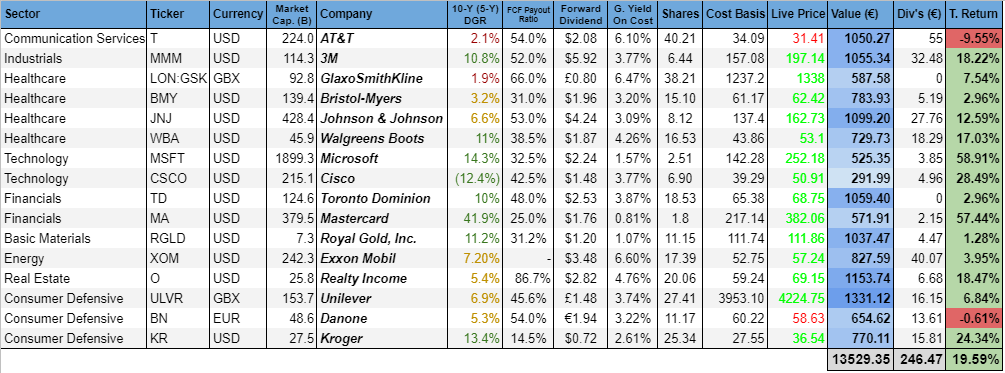

This was the outlook of my holdings in the end of the month:

A flat month for my dividend portfolio. I did not have any major purchase or new contribution to this portfolio, I only reinvested dividends.

Vivid readers will have noticed a much shorter list of stocks as I sold all the free shares I had earned on Trading212 for a total value of €583.87. As these are blog earnings, approximately 50% went to Kiva, and the other 50% into my new Global Clean energy ETF, which are both parts of my €45K Project fund (more details below). Since Trading 212 decided to limit the number of people joining the platform, I haven’t earned any new free share, so I thought it would a good time to sell, donate and forget.

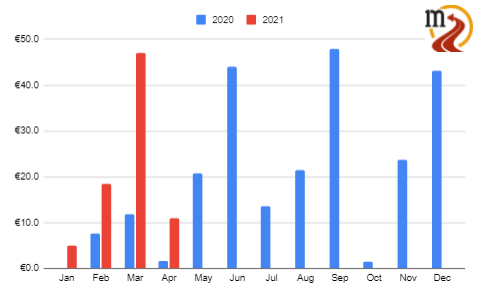

Dividend Payments

In April, I received dividend payments from a total of 5 companies:

- Cisco (CSCO): 1.78€

- AstraZeneca (AZN): 3.23€

- Royal Gold (RGLD): 2.36€

- Realty Income (O): 3.35€

- Royal Dutch Shell (RDSA): 0.24€

Total Dividend Income: 10.98€

Here’s in an update on my year-over-year dividend monthly income comparison, it keeps looking good.

The €45K Project Fund

Another month has passed which means I saved another £60 as a non-smoker, cash that goes into my 45K Project Fund.

Abundance Investment issued another corporate investment with a higher yield, but unfortunately, I was too late and missed it. I no longer fit in this “race to invest” scenario, so I decided to abandon the idea of building this fund out of P2P investments only and switched to the Global Clean energy ETF I´ve mentioned earlier in this post. Basically, if there are no ethical loans I like at the end of the month, I will buy more shares of this ETF. That is simpler than keeping the money as cash in the await of interesting loans.

So far The 45K Project Fund consists of:

- Abundance Investment: 1,427.7€ (1,452.2€ last month).

- Kiva: 405.25€ (82.49€ last month).

- Qardus: 277.9€ (364.5€ last month).

- Global Clean Energy ETF: 371.6€

So far, I have recovered 5.52% of my loss = 2,482.45€

42,517.55€ left to go.

Related content: How I FIRED 45k with algo trading, Investing Ethically, Recovering €45K through Investing in Myself First

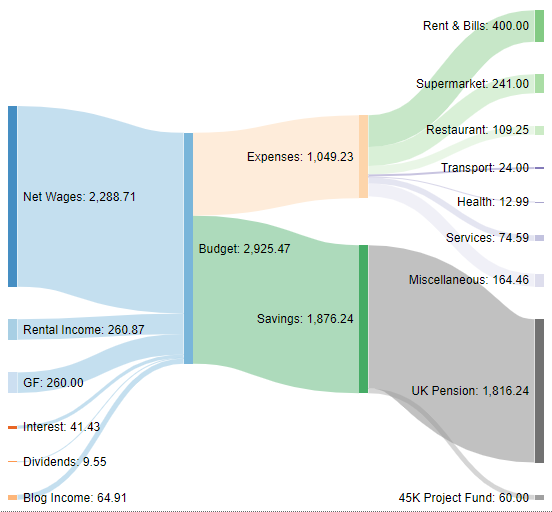

Goals and Habits 2021

It’s time to have a look at how I am doing with my 2021 goals and habits for 2021.

All my goals are monthly measurable, so I’ve built a table to keep an eye on the progress, this is how it is going so far:

Goals and Habits This Month

Goals and Habits Previous Month

I am generally doing ok with my goals. I am falling behind most of them but I am not too far from my desired target. However, my move to Spain is impacting some of my habits. I haven’t done any weight lifting since I moved as I can’t make a space in which I can train as I used to. I will need to get a proper gym mat as training on slabs as opposed to carpets is putting me off.

The book I am reading is Quiet: The Power of Introverts in a World That Can’t Stop Talking. I had this one on the list since I found out I am an INTP. As the name suggests, the book is targeting introverted readers, but I think anyone who is interested in psychology could enjoy it, as It´s got a lot of interesting research-based insights, case studies, and thoughtful conclusions. It helps understand why extroverts and introverts act differently, the science behind it, and also the cultural impact. American and European culture has placed extroverts as the golden standard. In the Asian culture is quite the opposite. Many introverts in Europe and America feel like they are weirdos among a major extroverted society, but we are just wired differently, and there´s nothing wrong with it. It will interesting to read more about this topic as science improves

That’s all for the April 2021 portfolio update, I hope you have a great month wherever you are, and thanks for reading.

All the best,

Tony Tanned 😉

Tags In

Tony

Related Posts

7 Comments

Leave a ReplyCancel reply

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

FINANCIAL TOOLS I USE

Online Banking

Crypto

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Glad to hear you made it back successfully to Spain. Not so good to hear about the lack of electricity though! Hopefully your reintegration to Spanish living goes well 🙂

As a fellow introvert (I usually get INT* on those tests, although haven’t done one in ages), that book sounds interesting. I’d be interested to read your top 2-3 takeaways from it, once you’ve finished reading it!

Thanks Doc. I shall make the effort :).

Great post. I’m very curious, what was your experience with mintos and robocash? I see you have exited both platforms some time ago.

I find mintos a bit disappointing, despite being leader in the P2P market, they have had many issues with some loan originators and they are constantly changing ratings in their market place. Robocash on the other side has been very stable, with a few hiccups, but almost no delays and good returns.

I recently exited bondora for example, but I’m still in mintos and a few more.

Thanks for sharing!

Hey thanks for your positive feedback, Juan.

My experience with Mintos and Robocash were both good. I exited Mintos because they stopped accepting UK resident investors. Now that I am back in Spain I could rejoin, but I do hesitate after all the issues you mentioned.

Robocash is stable, but I think they have no intention of becoming a regulated entity, which puts me off when I see part of their business is set in Russia…

I am confident by lending to property-backed loans instead of loans with risker collateral assets such as cars. I rather stick to this principle for now.

Hi Toni

Congrats on a solid month. A nicely diversified passive income stream and strong savings rate.

Reinvest24, I thought I‘ve seen them also as loan originaler of EvoEstate? Is that not the case anymore?

Cheers

Thanks my MyFinancialShape,

That’s correct. Reinvest24 is a loan originator in EvoEstate. I only invested in Reinvest24 and Brickstarter via EvoEstate before exiting last year. I don’t want to spread my funds across dozens of platforms, that’s why I’ve now skipped Evie state, as I don’t plan to invest in other platforms (loan originators) any time soon.

Cheers 😉

[…] One Million Journey Portfolio & Savings Update #29 April 2021 – 143,571€ […]