Portfolio & Savings Update #37 December 2021 – €190,362

Happy new year, everyone! Another month (and year) went by, which means it is time for another monthly portfolio & savings update to count in December 2021.

Table of Contents

December In A Nutshell

Despite the covid fear increase and tighter restrictions originated by the Omicron variant, we managed to proceed with our Christmas plans with no major disruptions.

It was rather stressful, though! In less than two weeks we’ve been in four countries, driven more than 15 hours, packed and unpacked several kilos of clothing and computing accessories, checked if newer restrictions were added dozens of times and filled up way too many forms. Despite this, we were actually quite lucky, as we didn’t need to pay for any costly PCR test for travelling.

So, how was it to spend Christmas in The Czech Republic? — It was really enjoyable!

Christmas times in Portugal and Spain just don’t feel like real Christmas. We could still see people sunbathing in Portugal just before leaving, which is cool, but playing with a snowman in late December beats any sunshine if you ask me! Temperatures around zero degrees, snow and love is all we want from Christmas right, and that’s what I had.

As I still struggle with my Czech (I basically don’t understand a thing yet) my main focus was to get my belly 1% better every day and trust me, I did do a good job with it! It compounded quickly! 😉 Who is brave enough to say “no, I had enough food thanks” to your mother-in-law? Not me, definitely! 🙂

Now we are “settled” back in Spain in that flat I am supposed to be selling at some point. We’ll stay here until our next adventure begins, which given the current virus situation, I am not too sure when that will be. For now, we see January as a staying-quiet month, which I welcome very much since we’ve been pretty much moving around all the time since September.

Let’s jump into the numbers.

Quick Recap of December Numbers

- Portfolio value: €190,362 (+5.9%) – details HERE

- Contributions to the portfolio: €4,740

- Monthly growth from investments: €2,564

- Passive income: €1,240 – details HERE

- Savings Rate: 54.5%

Contributions

- €114 to UK Work pension.

- €6,545 to buy FTSE All-World Acc shares.

- €1,483 to buy crypto

- €200 added to my Reinvest24* account.

- €-3,603 withdrawn from P2P.

Comments

The pound sterling gained against the euro (1.17 to 1.19), hence the mismatch on the recap numbers.

Overall, and counting in my contributions, my portfolio has managed to grow by €10,601, I am now getting closer to crossing the €200K mark!

My passive income sees a slight improvement compared to last month thanks to a great month in both dividends and earned interests from P2P.

Sold several of my property shares in the Property Partner platform and bought more global equities instead.

Monthly Income and Expenses

This month, the family income was £4,483.74 (5,335.65 EUR).

This is the outlook of my income and expenses in 2021:

As this was a transitional year for me, the chart above it is not much of a help. After changing my accounting system in May, there’s not a lot I can compare with the previous year. Waiting to the year-end to change accountability would have been better for comparison purposes, but since the purpose of doing this exercise is to improve savings, the sooner the implementation started the better. Despite the mess, I am glad I did this as thanks to it, I manage to lower many of my mum’s (now mine) bills, I now spend less on electricity (despite the hikes), internet and phone tariffs.

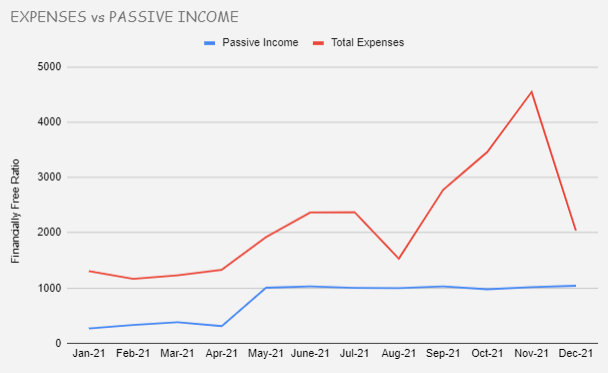

Let’s now have a look at how my expenses compare to my passive income stream levels for this year:

Not great right? That spike in November thanks to a roof fixing bill is still painful to me. I am actually glad it was late 2021, so I can just start a new chart for 2022 and forget about it! 🙂 It’s nice to see the passive income steadiness during this year as no major surprises in the P2P world occurred and even if they do in 2022 the impact on my passive income will be minimal since I cut my P2P allocation down considerably this year.

My total passive income covered 36.1% of my total yearly expenses.

I will be doing a yearly recap in a different blog post, so expect some lovely charting coming shortly!

Portfolio Performance

As I like to do on a monthly basis, this is a breakdown of all my current and past investments:

Please note, links containing a star (*) are either affiliate or referral links. P2P lending is a risky business, so you could end up losing all your invested money if you choose to join any of these platforms.

** 20 % discounted to estimate future withdrawal tax payments

December was another good month for equities, Santa’s rally ended up “materializing” and gave us the last 2021’s endorphin injection. My dividend portfolio felt the highest by increasing a whopping +8.5%! The final performance for 2021 is 24.55%. It seems like a crazy return, but if you take the S&P500 as “the market” then I’ve underperformed as the yearly return for this index was 27%. The world index has rallied 16.7% in 2021, so if taken this as a reference instead, then my dividend portfolio has outperformed.

However, the percentage I care about the most at the present moment is that -7.3% which still remains negative, maybe 2022 will change that?

Crypto Portfolio

In December, I had two further additions to my crypto portfolio. I bought more Ethereum ($574) and added Bitcoin ($1126.5) to my mini crypto portfolio. I wanted to avoid buying Bitcoin as I am not so in favour of the climate impact of the proof-of-work technology, but being in crypto and not owning a piece of Bitcoin just didn’t seem right.

Putting on the side the price of $LUNA, all the other cryptocurrencies performed quite badly. I am quite new to crypto, so I need to see how much time it takes to keep track of it, and how I deal with the volatility. It could well be that I decide to buy a crypto ETF for a high fee and call it a day.

The other option could be to use a crypto lending platform, but I have high concerns with its regulation, so I won’t be entering this space for the time being. Furthermore, it doesn’t make too much sense to me to use a centralized platform to invest in decentralized finance, I just can’t make it work in my brains.

Alternative Investments Portfolio

My alternative investment portfolio provided me with €119.3 (€78.1 last month) of passive income this month.

This is a better than expected value thanks to mainly Crowdestor. I am starting to see an income pattern I like in this platform, if this continues during 2022 I may think about keeping the platform in the roaster for a longer-term.

I decided to say goodbye to Property Partner, hopefully for good. I could be making the right decision at the wrong time, but after almost 5 years invested in it and seeing a continued underperformance against the UK Property benchmark, it doesn’t make sense to keep hoping. Putting on the side one property which I expect will be sold in early 2022, I put all the others on sale. I managed to sell many of them and got a slight profit overall, I only have two properties left, but these are unfortunately selling at a huge discount, so I am happy to wait for a little longer until the price hopefully recovers. As mentioned above, I used the proceedings to buy more global equities. I should have done this MUCH earlier!

The only addition I had this month was €200 in Reinvest24. I quite like their 6 months developments loans at 12.5% with monthly interests and secured with a first-rank mortgage.

For the time being, apart from Reinvest24 and Estateguru, I keep withdrawing funds from whichever platform I can.

In case you’d be interested in joining any of these two platforms, these are my referral links:

Dividend Portfolio

My dividend portfolio this month generated €52.5 of passive income.

This was the outlook of my holdings at the end of the month:

As usual, I reinvested all dividend payments in the same stock. No further contributions this month.

In order to increase the sector diversification of my portfolio, I will be looking to add an insurance company. I will be doing some reading and research to see whether I find something interesting in the next weeks/months.

Dividend Payments

I received dividend payments from a total of 8 companies:

- 3M (MMM): €7.25

- Johnson & Johnson (JNJ): €6.54

- Walgreens Boots (WBA): €6.01

- Unilever (ULVR): €11.82

- Kroger (KR): €4.02

- Microsoft (MSFT): €1.17

- ExxonMobil (XOM): €11.82

- Realty Income (O): €3.91

Here’s an update on my year-over-year dividend comparison:

Motivated to keep this ball rolling. Total dividend income this year was €390, a 64% increase compared to last year. Besides some beers, this could have paid my expenses in the health category for 2021. It would be good to surpass €500 in 2022. Will I manage?

The €45K Project Fund

Another month has passed, which means I saved another €60 as a non-smoker, cash that goes into my 45K Project Fund.

For now, I am investing it all in a global clean energy ETF.

So far, The 45K Project Fund consists of:

- Abundance Investment: €1,521

- Kiva: €460

- Qardus: €168.6

- Global Clean Energy ETF: €976.6

So far, I have recovered 6.91% of my loss = €3,126.2

€41,873.8 left to go.

Related content: How I FIRED 45k with algo trading, Investing Ethically, Recovering €45K through Investing in Myself First

Blog Income 2021

This year was not a good one for my blog. I’ve barely written 20 blog posts and most of them were just portfolio updates, I had even fewer views and than the first year. For some reason, Google penalized my blog, my posts wouldn’t rank and stopped showing ads. I didn’t care much about it as I was busy cleaning, sorting and selling since May. Now it seems to be sorted.

The only payment I received from Adsense was in April for the amount of £64.91.

Affiliate income was also poor as I received only one payment worth €67.46 as shown on the image below:

In addition to this, I earned an extra €7.42 of referral income and £50 worth of free shares in Trading212 earlier this year.

All this summed up and converted into Euros is €210 give or take.

So, how much did I donate? I promised I would donate 50% of my blog income, did I comply with it?

In 2021, I contributed $425 (€372) to Kiva and €70 to a local charity called Cruz Roja, so in total, I donated €442 in 2021 which is more than double what I earned via this blog.

Whether I make money or not, I am going to keep donating money, especially to Cruz Roja. This local charity was very helpful to my mum. Some volunteers came to visit her in the hospital and took her for a stroll while I was in the UK, stuck because of the pandemic. Since then, I decide to become a member and contribute 10 euros a month for the course.

Having said that and taking into account that my activity in 2022 won’t be much higher than in 2021, it’s quite unlikely I make more than €240, so unless something changes I will no longer be sharing my blog income and donations.

Regarding my 2021 goals, I will do a recap and set new ones in an upcoming post.

Hope you had a great December.

Tony

Related Posts

12 Comments

Leave a ReplyCancel reply

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

FINANCIAL TOOLS I USE

Online Banking

Crypto

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Not bad, Tony! You’re going to get harder and harder to catch for me! 😛

24.5% return is great! Lets hope for plenty more of those years, huh? 🙂

I have a thought! Given your fondness of snow and mine for sun, we should house swap during the holidays! :p (only if you settle somewhere warm though! Haha)

Cheers and happy new year 🙂

I’m very excited for 2022, I must say! Bring it on!

Thanks Nick. What matters at the end of the day is the NW, isn’t it? 😉

Haha I’ll ask my partner what she thinks about this, maybe it has an input in our decision making? :p

Likewise, happy new year Nick. Also have good vibes for 2022, let’s embrace it with enthusiasm!

Hello Tony, where was that title photo made? Was it in Kyjov (Czech Republic)?

Hey Tomas, that’s correct! Took it myself 🙂

Haha, that’s not even possible! I live there with my wife. :).

Aww wow! Such a coincidence! It won’t be the last time I go, so would be great to meet for a coffee or drink next time. Loved Pražírna Kyjov coffee shop.

Nice update T.

Thanks Steve!

Good update Tony.

I see you mentioned that you’re not a fan of BTC due to POW. If you haven’t already, have a look at Cardano (ADA), as it’s POS (Something ETH is trying to migrate over to with ETH 2.0).

A few ADA stake pool operators run off Raspberry PIs – Pretty good for the environment!

Thanks for your input, Mark. Need to learn more about Cardano and also Algorand as they claim to be carbon negative.

[…] my previous update, I mentioned I was considering the option to stick to a crypto index fund and forget about buying […]

[…] numbers for 2021 are acceptable. I outlined some of these on my December’s update, but I shall check them out altogether with my 2021 […]