Portfolio & Savings Update #27 February 2021 – 128,428€

The second month of 2021, February, is behind us and thus time for another portfolio and savings update.

Table of Contents

February In A Nutshell

In February, I felt like I was regaining my balance back as my stress levels decreased. I worked no more Saturdays and I only stayed longer hours on occasional days. That allowed me to spend more time working on my goals and habits for this year, which makes me happier.

Besides having more free time I did not recover my interest in writing on my blog or tuning in a lot with other finance peers. I’ve come to the impression that I was spending too much time on Twitter before, and even though I met fascinating people, being too active on social media doesn’t apport anything to the habits I am building or my current goals. As a consequence, my blog stats have exponentially decreased, which is good in a way, as it feels more of a personal journal.

In addition, I think I’ve learnt most of the main financial lessons, and it all seems to be getting a bit repetitive. The only side of the financial world that is catching my attention is dividend investing, and I see this only as a plus as it is not needed to either become FI or reach my lovely million. from my point of view.

I am focusing more of my attention back on the mechanical engineering world, as it is a subject that stills interests me. I’ve put this on the sideline for way too long.

Moving Back To Spain

We have made it official, fly tickets bought and all notices required have been given, I am moving back to Spain and I am bringing my “churry” (GF) with me. I am so excited and she is too!

It’s a move that sooner or later had to happen as I have some matters that require my physical attention. We were planning on doing this before Covid-19 started, but we decided to postpone it until things got better. Time passed, and then I got a promotion. I took it as an interesting temporal challenge and opportunity to learn and gain some experience, but it didn’t end up turning too well either for me or my “churry”. With this current scenario, it seems like a good time to pack everything up and move back to Spain.

I already gave the news to some old friends, and they were delighted to have me back and meet us. It will feel great to connect with them after all this time!

As soon as I stop paying rent in the UK I will be financially independent. My current accounting method will be amended to take in all income in Euros from Spain. Just the warehouse rent alone (1k Euros gross approx) will be enough to cover expenses and food for both me and “churry” as we’ll have to pay no rent.

Furthermore, if things don’t change, I will continue working for my current employer from Spain. I thought that was not possible, but there’s an option to still be employed while living overseas. Googling it, I discovered that this option became popular for ex-pats during covid times. I will earn gross income and need to pay taxes once a year all at once. This means my money will be working for me before the government! Woohoo!

This last paragraph describes the reason why I continue working for my employer as they offered me this possibility which I am happy to give a try. However, they are expecting me to eventually come back. This is something we still don’t know as there are many possibilities to choose from moving forwards at this stage. I guess becoming FI means that we have time to decide what we will do with no pressure? Love the sound of that!

Time to have a look at the numbers.

Quick Recap of February Numbers

- Portfolio value: 128,428 € (+3.4%) – details HERE

- Contributions to the portfolio: 2006 €

- Monthly growth from investments: 628 €

- Passive income: 336.86 € – details HERE

- Savings Rate: 59.7%

Surprisingly I am still managing to be close to my target savings rate of 60%. My remaining P2P investments have generated positive cash flow this month as opposed to last month, so that compensated the extra income generated in January after selling the Fordkari.

Monthly Cash Flow Sankey Diagram

Total income in February equals £2,892.77 (3,326 EUR).

Total expenses are £1,165.1, in line with January.

I’ve seen an increase in transport cost since I am now going to work using the bus, a flat £81 a month against £60 average before. That extended to an annual basis is about a £250 difference, which is what I was paying for my car insurance. Add in any maintenance cost and having an extremely cheap car is more expensive than paying for the bus in my area. Buses are running almost empty, so I don’t think I am taking any major risk by using public transport.

I will be looking forward to amending the Rent & Bills expense category for bills only once we have relocated to Spain at the end of April.

February Portfolio Performance

As I like to do on a monthly basis, this is a breakdown of all my current and past investments:

Please note, links containing a star (*) are either affiliate or referral links. P2P lending is a risky business, so you could end up losing all your invested money if you choose to join any of these platforms.

** 20 % discounted to estimate future withdrawal tax payments

Another month in which I am cutting distances with losses, moving from -24% in January to -23.1% in February. I am more enthusiastic about breaking even than increasing my levels of income or passive income. I should make some special celebration once I have reduced that to 0%. What it could be?

On the portfolio side of things, my investments in index funds suffered from a slight decrease whereas my pension and dividend portfolio enjoyed a nice gain.

A few comments in regard to my P2P investments:

Positive Outlook

- Property Partner announced that there will be more dividends recommencing on a further group of properties and dividend increases on selected properties that are already paying a dividend soon. 😀

- Crowdestate: I have no issues here. I withdrew some cash recently as there were no appealing loans to invest to.

- Estateguru: I had my first defaulted loan (50 Euros only). It eventually had to happen. This is my first defaulted loan since inception almost two years ago, which I think is an outstanding result. Estateguru has an excellent track record at recovering investors’ money, so I am still expecting to see this money back.

Negative Outlook

- Housers: Most of my investments stopped paying interest, not even the loan extension agreements between borrowers and investors are being fulfilled.

- Fast Invest: Waiting for withdrawal since beginning of January.

- Crowdestor: 12 out of my 18 loans are delayed or not paying anything.

Pound Sterling increases against the Euro from 1.13 to 1.15. Lovely!

Dividend Portfolio

My dividend portfolio in February generated 18.4 EUR of passive income.

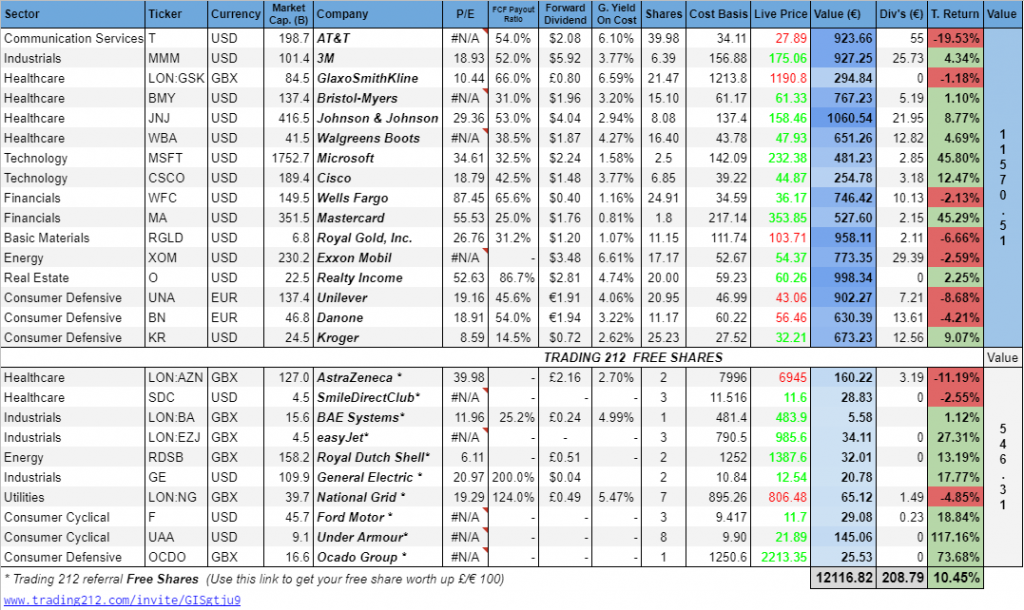

This is the outlook of my holdings in the end of the month:

The total value of my dividend portfolio grew to 12K, which makes almost 10% of the total value of my portfolio. That is the portion I want to keep it at.

I spent some time exchanging the payout ratio values for FCF payout ratios which are more relevant.

It’s now officially been one year since I started the gradual switch from P2P to dividend investing, which entitles me with the option to start comparing dividend income year over year. Call me a kid if you want to, but I am pretty thrilled to add this new chart in my blog, as it was the chart type I saw from others that most inspired me to start with dividends.

So, here it is, say hello to my new monthly dividend chart:

I started off on a good footing as February 2021 dividends more than double the previous year. 😀

Dividend Payments

Three companies paid dividends in February:

- AT&T (T): 12.66€

- Bristol-Myers (BMY): 5.19€

- Mastercard (MA): 0.55€

Total Dividend Income: 18.4 €

New Holdings And Purchases

Besides reinvesting all my dividends, I contributed 618 EUR and earned one free share this month, thank you!

If earning a free share worth up to £100 by depositing £1 sounds interesting to you, then I invite you to have a read here.

Monthly purchases and additions (except dividend reinvesting):

- BAE Systems (BA) 1 share @ p481.4 *FREE SHARE*

- Unilever (UNA) 4.5 shares @ 43.03 *ADDITION*

- Danone (BN) 2.16 share @ 53.12 *ADDITION*

- GlaxoSmithKline (GSK) 21.46 shares @ p1213.8 *NEW POSITION*

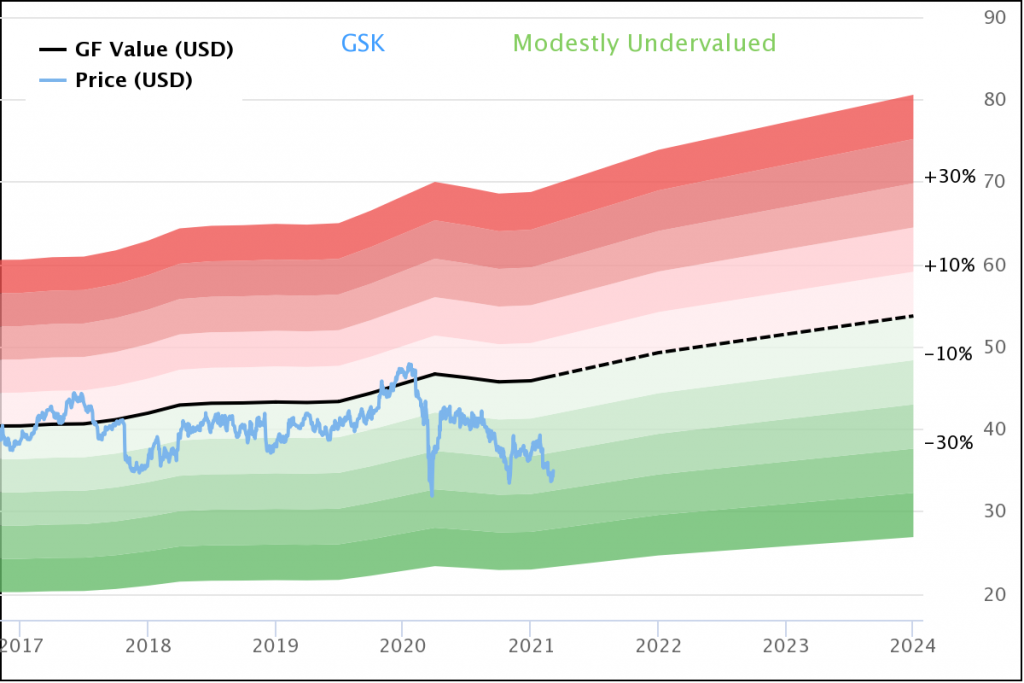

GlaxoSmithKline is my second British addition to the portfolio, being Unilever the first one. I haven’t been very keen on adding UK companies as I am already largely invested in Pound Sterlings, but I could not resist the temptation of buying some shares of GSK after its recent drop. To top it up, the fact that withholding taxes for UK companies is 0% makes it so tempting! I am considering to exchange my Unilever shares in Euros held in the Euronext index for the LSE in Pounds to avoid any withholding tax, even if I add more currency risk. Old readers will know how sensitive I am about paying unnecessary taxes.

A bit about GlaxoSmithKline:

The company operates in the healthcare sector, being a multinational pharmaceutical company and the world’s sixth largest pharmaceutical company headquarter in London.

According to MorningstarUK, “Glaxo has flagged up changes to its future dividend policy after its consumer healthcare business is spun off in 2022. Analysts at Morningstar expect this to be a substantial cut, as much as up to 40% initially, with dividends then increasing after 2022. With less dividend payments, we expect investment in innovation to increase and ultimately lead to faster earnings growth and eventual dividend increases after 2022.”

My take is that DGI fund managers and investors have not liked the idea of a possible dividend cut and have sold their shares, making the share price look like this:

GlaxoSmithKline is currently the top FTSE dividend-paying stocks with an expected yield of 6%. Even if we include a future dividend cut of 40%, the expected yield would be a respectable 3.6%, which would relocate the stock to the fourth position of the top payers of the FTSE Index according to Morningstar UK:

Facts And Figures I Liked About GlaxoSmithKline

- Wide moat

- High dividend yield

- No withholding taxes!

- FCF payout ratio of 66%

- Undervalued share price

- Dividends paid quarterly

- Global business with turnover +34bn

- Increasing FCF (5bn in 2029 vs 5.4bn in 2020)

- Dividend well covered (although it will be cut)

- The balance sheet could be healthier but high profitability compensates.

Disclaimer: Please remember that I am doing this solely for fun. Neither this is a professional analysis nor I have the knowledge to do it, so do your own due diligence before investing in individual shares.

The €45K Project Fund

Another month has passed which means I saved another £60 as a non-smoker, cash that goes into my 45K Project Fund.

I am still struggling to invest new contributions as Abundance Investment has gone quiet and Qardus offer a low amount of funding projects which become fully funded before I got a chance to invest. Abundance has announced some project will be available to investors in March-April, hopefully, that will become a reality.

So far The 45K Project Fund consists of:

- Abundance Investment: 1,163.2 EUR

- Kiva: 82.49 EUR

- Qardus: 354.6 EUR

- Cash: 194 EUR

So far, I have recovered 3.98% of my loss = 1,794.29 EUR

43,205.71 EUR left to go.

Related content: How I FIRED 45k with algo trading, Investing Ethically, Recovering €45K through Investing in Myself First

Goals and Habits 2021

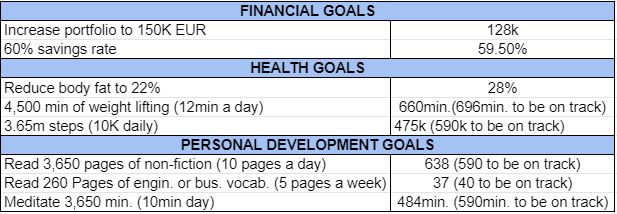

It’s time to have a look at how I am doing with my 2021 goals and habits for 2021.

All my goals are monthly measurable, so I’ve built a table to keep an eye on the progress, this is how it is going so far:

Goals and Habits This Month

Goals and Habits Previous Month

I am still falling behind most of my goals but I’ve managed to cut distances in February as I had more free time to work on them. If I continue as I’ve been doing this month, then I should be ok by the end of the year.

My injured foot got better during the month, I’ve started running again which has made a nice impact on my steps, positive mood and mindset. Really missed the endorphin release that occurs when running, now I am back at it. I am not pushing myself that much now and always do 10min warming and cooling down stretching exercises.

I’ve also been busy doing a strength program on Peloton which I really enjoyed. I gained a nice amount of muscle weight, although I put fat as well :(, also learning a lot about fitness and improved my balance considerably too! However, I am still much far away from getting that 6 pack though! At the moment I’ve got one big pack, just 5 left? Hahaha!

The book I read this month was The Psychology Of Money by Morgan Housel. It was an easy and enjoyable read. Most of the content was just remainders to me but there was a great piece of advise I had not read anywhere else before.

This content is written in chapter 14 titled You’ll Change. In it, the author discusses that long term planning is harder than it seems because people’s goals and desires change over time. No one knows what the future holds, we don’t know today what we will want in the future.

This is it for this month, I hope you have a great month wherever you are, and thanks for reading.

All the best,

Tony Pepperoni 😉

Tags In

Tony

Related Posts

13 Comments

Leave a ReplyCancel reply

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

FINANCIAL TOOLS I USE

Online Banking

Crypto

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

nice one T. What do you do with your ISA and UK work pension when you leave?

Thanks, Steve. For the time being, I’ll keep it all here as we may come back.

Spain! I knew it 😉 hope you have a good trip, and I’m sure the climate in Spain is going to do wonders for the mood too. Is your GF British? If so it’ll be a Big change for her I guess 🙂

I also like that dividend, although most studies point to it being worse than just a simple index in the Long run – but the psychological value of that income every month is worth the “gamble” I’d say 😛

I will also be looking to add more value to my dividend portfolio in the coming years. It would be nice to see just €100 or something every month.

She is from the Czech Republic, so still, a massive change for her although she is picking up Spanish rather quickly (and I discovered I am terrible as a teacher!)

100% agree, I am conscious that I am creating wealth slower by investing some of my funds in dividend payers, but as you say, earning some passive income every month is quite stimulating. At the end of the day, we need to enjoy the journey somehow, so that’s a price I am happy to pay for.

It would be nice to earn 100€ a month, that could pay some basic bills. ?

Big news, Tony! Sounds like good timing too – I guess that moving at the end of April will let you take full advantage of the Spanish spring. Much warmer and nicer than the UK!

Regarding ISAs – does Spain have anything similar?

Good luck to you and your gf with the move!

Thanks Doc!

I love springs in Spain but summers may get too hot sometimes. I may even struggle myself after all these years.

Nope, there’s nothing like ISAs and they will become taxable if I stay over 183 days in Spain. Not sure if I can still keep contributing for the next tax year though. I know I can contribute a certain amount (£3.6k I think) to my uk pension for up to five years without losing tax relief.

Thanks appreciated 🙂

Welcome back to manianaland. Uk is a good country, but there is no place like home 🙂 Good to see you joining the dividend investing club as well.

Thank you! Couldn’t agree more with that, good times ahead:).

Thanks, I am loving dividends very much 🙂 I saw you recently joined the crowdlending sphere, hope you’ll have better luck than mine with that.

Yeee but im keeping it at level I can aford to lose 1-2% from portfolio. Agraculture look like a good sector to be even for more risky farmers.

That’s a sensible percentage. I would like to be myself somewhere near 5%, still need to keep withdrawing.

Yes, agribusiness is interesting and relativity defensive as the population keeps increasing more farming is required. I would check that one out if I were still not in the withdrawal phase.

Wow that’s very exciting. I’m a little envious… sun, sea, sand, wine. Ah. Also, congratulations on reaching financial independence. I believe it’s traditional to say go F*ck yourself!

The Wealthster (the blogger formally known as Playing with FIRE UK).

Thanks a lot The Wealthster, I am glad to see you are still around.

I won’t probably be able to enjoy the Spanish lifestyle as much as I would like to as I will be very busy sorting stuff out, but yes, it will be great to at least enjoy some short Mediterranean style breaks! 🙂

Hopefully, we get an end to Covid-19 and you guys are able to come down soon.

[…] One Million Journey Portfolio & Savings Update #27 February 2021 – 128,428€ […]