P2P vs Dividend Investing – Pros and Cons

Investors are always looking for places to store their hard-earned cash. Albeit investing in index funds tends to be the preferred approach for the vast majority (especially retail investors) many are not happy by just simply putting all the eggs in one sole basket.

As Andrew Tobias said:

”Don’t put all your eggs in one basket. It may have a hole in it”

That impulse drives alternative thinking about investing. One of these alternatives may be investing in P2P lending companies. That is to lend your money in exchange for an interest. Another one could be dividend investing, which is buying stocks that offer stable dividends to its shareholders.

These two are both passive income investing strategies. I’ve been investing in both of them for a while, and I thought it could be a good idea to write a post about the main pros and cons of each strategy, which one I like the most and why.

Table of Contents

P2P Lending

P2P lending is a relatively new way of investing, having been only around for about a decade or so. It started to increase in popularity after the financial crash in 2008 up until 2019.

The crisis brought by the coronavirus pandemic is putting the industry under test. Some companies are doing well, but others bankrupted or are standing by the edge of a financial abyss.

I would like to highlight that anyone who considers P2P lending as an investment option for their savings should take into account the pros and cons and understand them well.

Many newbie investors are blurred by the idea that P2P lending is a passive way to make your money work for you safely. This is a common mistake, in which I, myself fell in too — investing in P2P is not safe.

Every investment carries a certain degree of risk. Understanding the pros and cons well is crucial in order to make an informed decision on whether P2P lending is for you or not.

Pros of P2P Lending

Inflation-beating, high target returns

For those investors who are willing and able to take the risks, P2P lending offers higher interest rates than the saving account in your bank.

Target rates are often upwards of 6%, which is generally higher than other, more traditional methods of investment. With bank interest rates now close to 0%, the difference is more substantial.

Non-correlation with the public markets

P2P lending is a form of alternative investment. The good part of this is that it does not correlate with public markets, meaning less volatility for your portfolio.

That can be useful during market corrections or bear markets, the time when I sell some of my loans to buy equities at a discount.

Diversification

The vast majority of platforms allows investors to spread their moneys across several loans and borrowers. That is useful to better manage your risk exposure with more diversification.

Chance to make an ethical investment

This is an overlooked advantage of investing with P2P lending, yet the most important to me.

Even though not every platform business model is transparent, many will give you the option to chose to whom you want to lend your money and for what causes.

Moreover, there are dozens of platforms out there that only provide ethical loans.

Cons of P2P Lending

No insurance or government protection

Government does not provide insurance or any form of protection to the lenders in case of losing your money.

In the UK P2P lending is not protected by the Financial Services Compensation Scheme (FSCS) should your P2P platform go bust.

Credit risk

Many of the loans available through the P2P lending marketplace are exposed to high credit risks.

Borrowers with a low credit rating are not able to borrow money from banks and need finance from others sources like P2P lending.

Taxes

Depending on the country where you live, this can be a pro or a con.

In the UK is a pro, since you don’t have to pay taxes as long as you are below Personal Savings Allowance, which is £1000 per tax year at the time of writing. There’s also the option to invest via IFISAs (Innovative Finance ISA), which allow users to invest up to £20K in a tax-wrapped account.

But for most countries in Europe, the tax man wants a cut on your interest returns, which is a big con.

High risk investment

Investing in P2P lending is generally a higher risk / higher return investment. But, there are many risks involved in P2P Lending, and albeit they are not too complicated to understand, it requires a certain degree of knowledge to invest in a balanced risk-rewarding way.

I wrote an article to detail all the risks an investor is taking when investing in P2P lending, you can read it by clicking on this link.

Community

My personal opinion about the P2P lending community is that is rather toxic and not trustworthy.

Affiliates and referral programs have a serious impact on investors opinion about platforms. That leads to dishonest reviews and some stabbing in each others back.

This doesn’t apply to everyone in the community, but investors should be picky at choosing who to follow and engage with.

Dividend Investing

Dividend investing is also growing in popularity among income investors, especially over the last years, as interest rates have remained at their lowest, and other popular income investment vehicles, such as bonds, pay near to nothing.

I am still relatively new to dividend investing, as I only started to take it slightly a bit more seriously at the best time I could possibly choose, in February 2020, just before global Covid-19 lockdowns hit.

Regardless of the bad timing, I don’t regret my choice. As I am a long term investor, this bad timing will barely be noticeable in the future. In addition, I view it as a way to reduce my exposure from P2P lending, engage with its friendly community and initiate a new motivating learning curve that hopefully will lead me to a safer financial sustainability by the time I retire.

Like everything in life, dividend investing has also some pros and cons, so I will try to dig a bit further on what I consider these are.

Dividend Investing Pros

Less risk

For what I can understand, dividend stocks are generally less risky than non-dividend stocks. This seems to be derived from two basic facts.

Firstly, as dividends are derived from company earnings, it seems fair to conclude that dividends could be a sign of financial health, although there are exceptions to rule.

Start-ups or loss-making companies can be seen as riskier investments as these are trying to get their market share, increase their revenues and make a profit, therefore not being able to pay a dividend to their shareholders.

Secondly, the cash provided by dividend payments can help to buffer corrections and bear markets, while giving an opportunity for stock price appreciation.

Transparency and safety

Dividend payments come from companies that are publicly listed on the stock market. As such, they must share their financial statements, usually in a quarterly basis, and follow a strict accounting policy.

This gives transparency on company numbers, allowing investors to make rational investment decisions as well as reducing the chance to become a victim of fraud, especially if we invest in US stocks.

Insurance or government protection

Government may provide insurance or other form of protection to the investors in case that the brokerage account where you hold your stocks goes bust.

In the UK this is carried by the Financial Services Compensation Scheme (FSCS).

Dividend Growth

This is the most attractive part of the dividend investing strategy, where reinvesting dividends makes up a huge part of overall returns. The longer the time period, the greater the impact of dividends on returns, as a result of the compounding effect.

Now imagine if besides enjoying the gains from the compounding effect itself, we also get annual dividends raises above levels of inflation. This adds another compounding effect on the top, which is helpful to accelerate returns exponentially faster. See the forecasted projection I added on the last part of this blog post!

Community

Generally, I found the dividend investor community to be positive, supportive, collaborative knowledgeable, eager to learn and share useful insights with each other.

In this community no one gets paid for recommending a stock, so ideas shared on the social media, blogs or forums are normally honest, although that doesn’t mean they are right and you should not go and buy any recommended stock without doing your own due diligence.

Dividend Investing Cons

Less stock appreciation

While it is certainly true that dividend stocks offer stock price appreciation compared to other fixed income investments, these are generally lower than growth stocks.

Dividend cuts or elimination

Companies can cut or completely eliminate dividend payments to shareholders if the company’s board of directors think so, therefore dividends are not guaranteed.

As I could learn from the coronavirus crisis, it doesn’t matter how sustainable a dividend payment may look. No one can predict the future, and unexpected events such as Covid-19, can put whole sectors in a serious financial constrain, putting at risk your beloved dividend payments from one quarter to another.

Taxes

This, once again, can be a pro or con, depending on your country of residence.

The UK, similarly as US, enjoys from some tax advantages that other European countries are not able to.

However, as far as I am concerned, a withholding tax apples to most dividend payments regardless of the investors’ residency. The broker will automatically deduct the withholding tax according to companies nationality rules.

For instance, if you invest in a Spanish company, dividend payments are subject to a 19% withholding tax, whereas if you invest in a British company, withholding taxes are 0% for both, residents and non-residents.

I take relevant information about taxes from the Deloitte’s site.

P2P Lending vs Dividend Investing

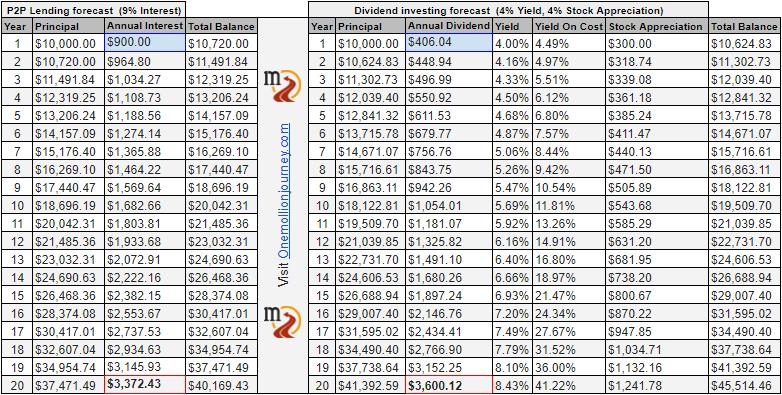

As a concluding experiment, I played a bit around with spreadsheets. I wanted to forecast a 20 years projection of 10K invested today in both investing strategies.

These are the considerations I have taken into account:

P2P

- 9% annual interest rates. (including defaults — optimistic rate)

- 20% on taxes

Dividend Investing

- 4% dividend yield

- 4% annual dividend growth

- 3% annual share appreciation (conservative)

- 20% on taxes

- Used the Market Beat dividend calculator

The total balance after 20 years is pretty close, the difference is not massive.

However, if we pay closer attention to the annual income year over year, we can notice how the dividend investing strategy gains more traction as time goes by.

This first year P2P Lending annual income more than doubles the dividend one, whereas at the 20th year dividends pay more than P2P interests. As I commented earlier, this is caused thanks to the dividend growth, which I believe is one of the main advantages of this investing strategy in particular.

Final words

I personally like to invest in both strategies, but if I had to choose one that would be dividend investing by a great substantial margin.

The main reason for this is because of its long term growth potential. When we invest in P2P lending, our returns are capped at the given interest rate while taking big risks.

What every investor wants is to limit the downsides (risks) whereas we don’t add restrictions to the upside return.

So, does investing in P2P lending makes any sense, then?

From my point of view, if you are willing to take bigger risks, then it can do, but only for short term investments, as P2P lending only offer higher returns during the first years of investment.

Over to you

Do you invest in P2P lending or in dividends? Which one is your favorite?

Insights are welcome.

Please leave a comment down below to share your thoughts.

Tags In

Tony

Related Posts

4 Comments

Leave a ReplyCancel reply

ABOUT ME

SUBSCRIBE TO BLOG VIA EMAIL

FINANCIAL TOOLS I USE

Online Banking

Crypto

Zero Commission Stock Investment Apps

(free share worth up to €/£100)

Index Funds Investing Accounts

(up to £50 bonus)

(no management fee for 1 year, Spain only)

Others

(Get it for FREE)

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

Hi there! It's Tony here and I am hoping to post my journey towards one million euros.

I think I have about £20 left in P2P – I’m happy to have tried it out and gotten on average around 6-7% returns but am happier that I’ve withdrawn my money and it’s now invested in stocks and shares. I can’t imagine how it must be for people who have a lot in P2P and who have struggled with the liquidity aspect.

Would you ever consider adding investment trusts to your dividend portfolio?

6-7% isn’t that bad considering that returns in the UK are generally lower than other European P2P platforms. Yours is a happy ending story, mine is a painful one at the moment but hopefully it will turn a bit better over the long term. And yes liquidity risks are high in this industry, I am glad the FCA is adding some new rules as the 10% investable assets limit.

Maybe, I am more inclined to individual stocks or ETFs. I would like to add REITs at some point. New to learn more about IT.

My brief foray into P2P landed me 3% returns and an uncomfortable ride the whole time. I thankfully got out early; I can only foresee even rockier roads ahead for P2P in 2021.

I can understand the attraction of dividend investing for passive income, but for me its just a distraction from a global equity index fund. Sure it’s all in one basket – but the global economy is a pretty big basket!

3% is still better than me 😉

Given the current situation I foresee some pain too. It’s hard to make a return nowadays.

I invest mostly in global funds, and although it seems a big basket it’s largely driven by the top technological companies such as Microsoft, Google of growth companies, so addiding companies with a more attractive price is still a thing for some investors.

I personally still like to keep most my money in global funds, and use dividends to have just some fun.

Thanks medfi.